A reoccurring misconception by home buyers to secure their home loans using government programs such as FHA or VA is costing them $$$. The true story below illustrates the unfortunate situation.

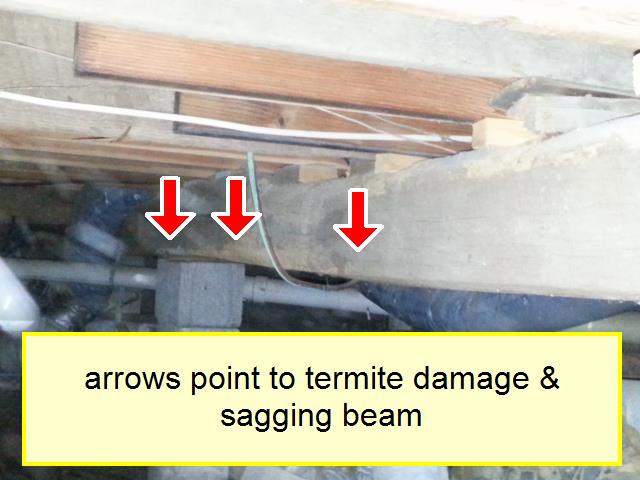

As part of the home inspection, I entered the crawlspace and found that the beams and sills of the home were severely compromised from years of termite and moisture contact.  Large beams were cracked and sagged under the weight. Temporary DIY repairs had been attempted at some point in the past but were inadequate. This was a major structural issue that needed correction.

Large beams were cracked and sagged under the weight. Temporary DIY repairs had been attempted at some point in the past but were inadequate. This was a major structural issue that needed correction.

The seller was home at the time of the inspection and was shocked to hear about the structural condition of the home. He had only lived there a few years (damage would likely have gone back decades). I asked if he had the home inspected before he purchased it and he said yes, at the same time as the appraisal. “The appraiser performed the inspection at the same time”, he said. Unfortunately, this type of story occurs quite often.

This is a common mistake that some buyers make. There could be multiple reasons why buyers might think a government loan appraisal includes an inspection, but the truth is, IT DOES NOT.

The FHA requires a property appraisal, and that homes meet certain “minimum property requirements”. A “property condition survey” conducted by the appraiser, does not compare to a home inspection. An appraiser may be in the home for 20 minutes, while inspectors average 3 1/2 to 4 hours at most properties. HUD has released a document, click here to view, that says the FHA does not perform home inspections and instructs buyers to get a home inspection before you buy.

The truth is that FHA does not guarantee the value or condition of a home, FHA appraisals are to protect FHA, and homebuyers should protect themselves by ordering a home inspection.

You can contact us at 217-303-8633 to answer your questions or schedule your inspection. You can also schedule your inspection online by clicking here.